Resources

Helpful links

How to register for tax

To pay tax you'll want a Tax File Number (TFN). You use this when filing tax returns. You can apply for one here.

To register for a delivery platform you'll need a Australian Business Number (ABN). This is the public identifier for your "company". You can apply here. If you registered for a TFN you should enter this in the ABN application form.

To register for a delivery platform you'll need a Australian Business Number (ABN). This is the public identifier for your "company". You can apply here. If you registered for a TFN you should enter this in the ABN application form.

How much tax will I need to pay, and when?

You'll need to track the hours you've worked and your expenses to accurately declare tax. You could use a contractor job tracking app Quickbooks.

Click here for a map of listed public toilets across Australia

Click here for a map of listed public toilets across Australia

Where should I work?

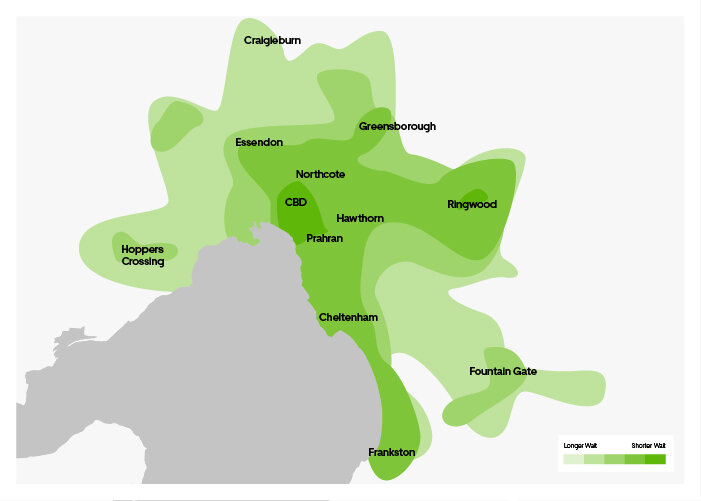

This map shows the busiest areas of Melbourne.

When should I work?

Best time to do deliveries:

- Weekdays

- Lunch - between 11:00am and 2:00pm near the CBD and business centres.

- Dinner - between 5:30pm and 8:30pm near the CBD and in the suburbs.

- Weekends

- Friday and Saturday nights between 5:00pm and 10:00pm, most of the demand comes around your city’s main restaurant and nightlife hotspots.

- Saturday and Sunday between 9:00am and 3:00pm, demand usually spikes over brunch and continues through lunch.

- Sunday all day, demand usually spikes at lunch and dinner but is generally busier than any weekday afternoon.

Questionnaire

Location: 506 Elizabeth Street (Multicultural Hub), Melbourne VIC 3000

Opening Hours: 4pm to 9pm, Wednesday to Sunday

Opening Hours: 4pm to 9pm, Wednesday to Sunday

The Gig Workers’ Hub operates on the lands of the Wurundjeri & Boonwurrung people of the Eastern Kulin Nation. Always was, always will be Aboriginal land.

GWH’s Major Partners are City of Melbourne, DoorDash, and HungryPanda